Market Commentary–3rd Quarter, 2013

Stock markets enjoyed a strong rally in the quarter ending September 30, 2013. The S&P 500 Index generated returns of 5.2% for the quarter, while the MSCI EAFE international return exceeded 10%. Stocks benefited from continued growth in the U.S. economy, improving economic conditions in Europe and China, and reduced political tensions related to Syria and Iran. The S&P 500 Index finished the quarter with year-to-date returns of almost 20%. The table below shows the performance of major market sectors for various time periods.

Performance of Major Indexes for Periods Ending on September 30, 2013

|

|

|

|

|

Annualized |

||||

|

Index |

Sector |

Qtr |

YTD |

1-Year |

3-Year |

5-Year |

10-Year |

|

|

S&P 500 |

Large US Co. |

5.2% |

19.8% |

19.3% |

16.3% |

10.0% |

7.6% |

|

|

MSCI EAFE |

Large Foreign Stocks |

10.9% |

13.4% |

20.4% |

5.2% |

3.2% |

5.1% |

|

|

BarCap |

US Bond Mkt. |

0.6% |

-1.9% |

-1.7% |

2.9% |

5.4% |

4.6% |

|

The beginning of the current 5-year period coincides with the global financial meltdown in the fall of 2008. As losses mounted, some investors decided to pull out of the market. Many of them waited until a year or two for some stability before re-investing. Those who remained committed to stocks enjoyed a 10% average annual return in the last 5 years (measured by the S&P 500), close to the historical average. We think investors should have learned some lessons from this experience, as expressed by Warren Buffet, one of the most successful investors our times:

- Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it.

- When others are fearful, be greedy; When others are greedy, be fearful.

- Always invest for the long term.

While the recent strong market performance is a welcomed reward for long-term investors who stayed the course over the past five years, it also raises some concern that investors are becoming exuberant. Stock prices have risen much faster than company earnings over the past year, making valuations relatively less attractive. Although the economy is still expanding, it still requires a significant amount of support from the Federal Reserve through the current quantitative easing (bond buying) program.

Stocks rallied in September when the Federal Reserve (the “Fed”) announced that it would not begin to taper its $85 billion per month quantitative easing program. This came as a surprise, since the Fed had hinted in May that it would slow its purchases of bonds in the near future. The Fed’s bond buying program is intended to keep interest rates low in order to stimulate the economy. Lower interest rates make it easier and cheaper for businesses and consumers to borrow and then to use the money to buy goods and services.

The Fed buys bonds in the marketplace, rather than directly from the Treasury. By competing with other market participants and adding to the demand for government bonds, the interest rate that the Treasury has to pay investors is very low. At the end of September, the interest rate on the 10-year Treasury bond was just 2.62%. The 85-year average interest rate for 10-year Treasury bonds is 5.1%, or about 2.0% higher than the average inflation rate of 3.1%. Investors who might normally invest in Treasuries have turned to riskier assets, such as corporate bonds and stocks, to get a higher return. So by purchasing government bonds, the Federal Reserve not only encourages borrowing and consumption by keeping interest rates low, it supports higher asset prices by creating demand for riskier assets. It almost sounds too good to be true. (It begs the question: Is this creating an asset bubble?)

Since its first quantitative easing program began about five years ago, the Fed’s balance sheet has expanded from less the $1 trillion in assets to over $3.7 trillion, and it is growing at roughly $85 billion each month. While the Fed’s assets include both Treasury securities and mortgage backed securities, the holdings are significant when considering that the national debt is $17 trillion. Eventually the Fed will buy less bonds (taper), then it will stop buying bonds, and at some point it will need to sell bonds or at the very least allow them to mature. So far, the program has worked well, but there is significant risk in unwinding it. Fed Chairman Ben Bernanke has taken the spaceship to Mars, now his successor will have to get it back safely. It will be no easy task.

The Fed intends to continue to stimulate the economy until unemployment falls to 6.5%. The unemployment rate currently stands at 7.3%. Real GDP (the measure of all goods and services adjusted for inflation) is now 4.3% higher than it pre-recession peak in the second quarter of 2007. However, during that same time frame the total number of people employed fell by 1.2% from 137.7 million workers to 136.1 million. As a nation, we are now producing more goods with less workers. The U.S. is more productive due mainly to greater automation and a nimble workforce. So there is some possibility that as we continue to increase productivity it will be increasingly harder to lower the unemployment rate. Ultimately, employment can increase if the economy grows more quickly or if the total hours worked is spread over a larger number of people. However, that assumes that those currently unemployed have adequate abilities to do the work as more knowledge-based skills are required by employers.

Bond markets recovered somewhat in the third quarter, helped by the Federal Reserve’s decision to maintain its bond buying program. The Barclays Aggregate Bond Index, the broadest benchmark of the U.S. bond market, generated returns of 0.6% for the third quarter. However, this index has posted a loss of 1.9% for the year-to-date period as interest rates have risen significantly since the beginning of the year. The yield on the 10-year Treasury bond ended the quarter at 2.62%, up sharply from 1.76% at the beginning of the year. Longer-term fixed income investments still appear to be unattractive considering that interest rates will likely increase, especially as the Fed unwinds it quantitative easing program.

With the stock market near record levels and signs of market speculation increasing, a degree of caution is warranted. While companies are performing well in the current environment, so much of future performance is dependent on the successful actions of government leaders, policy makers, and bureaucrats. In addition to being dependent on Federal Reserve policy, markets will also be impacted by the outcome of the current budget stalemate and debt ceiling negotiations. Looking ahead, stocks are likely to outperform other asset classes as the economy continues to improve. However, considering the uncertainties, investors could experience greater volatility and more moderate returns in the near term.

Please contact us if you have any questions about the markets or your accounts.

— Tom Franks & Kirk Weiss

Market Commentary–2nd Quarter, 2013

In May of this year the S&P 500 Index reached at an all-time high. At that point, the index had already generated a 17% total return for the year. The move upward for equity markets was remarkably steady. The S&P 500 advanced for more than six months without a 5% correction.

The calm disappeared in late May, when Federal Reserve Chairman Ben Bernanke hinted that the Fed’s current bond buying program would begin to be “tapered” in the near future. What happened next has been described as a “taper tantrum” by both the stock and bond markets which have become “addicted” to historically low rates. The charts below show key trends during the quarter.

The 10-year Treasury note traded below a 2% yield on the day before Bernanke’s testimony. Since then, the yield on the 10-year Treasury bond increased to as high as 2.66% and closed the quarter at 2.48%. In the weeks following Bernanke’s testimony the S&P 500 declined by 5.8% to its lowest level of the quarter on June 24. After seeing how the markets reacted very negatively to Bernanke’s speech, the Federal Reserve went into “damage control” mode, with many Governors then making comments that suggested that the Federal Reserve was going to be very slow and careful when reducing or “tapering” the stimulus program.

Despite the Fed’s efforts to calm the markets, higher rates caused bond prices to drop, and investors yanked a record $60 billion in June from bond funds. The volatility put a damper on quarterly returns, as shown in the following table.

Total Returns: Major Indexes for Periods Ending on June 30, 2013

|

|

|

|

|

Annualized |

||||

|

Index |

Sector |

Qtr |

YTD |

1-Year |

3-Year |

5-Year |

10-Year |

|

|

S&P 500 |

Large US Cos |

2.9% |

13.8% |

20.6% |

18.5% |

7.0% |

7.3% |

|

|

MSCI EAFE |

Large Foreign Stocks |

-2.1% |

2.2% |

15.1% |

6.7% |

-3.6% |

4.8% |

|

|

BarCap |

US Bond Mkt. |

-2.3% |

-2.4% |

-0.7% |

3.5% |

5.2% |

4.5% |

|

The sudden increase in interest rates and bond fund outflows created losses in the bond market. The Barclays Aggregate Bond Index, the broadest benchmark of the U.S. bond market, produced a loss of 2.3% for the second quarter and a loss of 2.4% for the first six months of 2013. The yield on the 10-year Treasury bond ended the quarter at 2.48%, up sharply from 1.85% at the end of March and from 1.76% at the beginning of the year. The likelihood that interest rates will continue to increase, especially as the Fed curtails its bond buying program, makes longer-term fixed income investments unattractive. A rising interest rate environment will also create a headwind for stocks.

While U.S. stocks have produced very strong returns over the past three years and have recently reached new record levels, international markets have struggled. GDP growth in both developed and emerging markets has been disappointing in 2013. Europe is in a recession, with GDP declining for the sixth consecutive quarter for the block of 17 countries that use the euro as their currency. While emerging market economies are forecasted to grow 5.3% in 2013, this is a much slower pace than most of the past decade. Considering the long-term prospects for strong emerging market growth, this sector of the market appears to be attractive based on most valuation metrics.

Bernanke suggested the tapering could be expected due to an improving economy so apparently, good news for the economy can be bad news for the stock market when it causes rates to rise. In fact, most economic indicators point to a slow but steady economic expansion. Pending home sales in May reached a six-year high. Auto production is now running at an annual rate of 15 million vehicles, up from 9 million at the bottom of the recession. U.S. oil production increased at its fastest rate in decades. GDP grew a modest 1.8% in the first quarter, just below its 2.0% average since the beginning of the expansion in July 2009.

It is likely that quantitative easing had the effect of inflating asset prices, in particular home prices and stocks. Lower interest rates kept borrowing costs low making it easier to buy a home. Lower rates also made stocks more attractive when compared to lower-yield fixed income securities. (While increasing the value of homes and stocks was not a stated objective of quantitative easing, the increase in household wealth helps to stimulate the economy and reduce unemployment.) With quantitative easing winding down, there should be less upward pressure on asset values. .

Despite rising stock and home prices, overall inflation remained below the Fed’s target of 2%. The price of gold has continued its decline, despite the concern that the Fed’s monetary easing would spur inflation and debase the US dollar. At the end of the quarter, gold was $1239/oz, down 35% from its peak of $1921/oz in September 2011. Higher interest rates and greater economic stability have made the metal less attractive. We continue to avoid precious metals for now.

Considering that the major U.S. market indices have already produced double-digit gains in 2013 and that interest rates appear to be increasing, it would not be surprising to see stock performance moderate in the second half of the year. Further market gains will likely require continuing positive developments in the U.S. economy, signs of a turnaround in Europe, and stronger growth from emerging markets.

Please contact us if you have any questions about the markets or your accounts.

— Tom Franks & Kirk Weiss

Market Commentary—1st Quarter, 2013

Most U.S. stock market indices advanced to record levels during the first quarter of 2013. The S&P 500 Index set a new record on the final trading day of the quarter, exceeding its previous peak set on October 9, 2007. This milestone is particularly significant, since the S&P 500 Index represents about 72% of the market value of all publicly traded U.S. companies. The Dow Jones Industrial Average (30 large blue chip companies) and the Russell 2000 Index (small companies) also reached record levels during the quarter. The NASDAQ Composite Index closed the quarter 14.3% above its October 2007 peak level of 2859. However, as a reminder of the dangers of speculation, the NASDAQ would need to advance another 54.5% to reach its March 2000 all-time high of 5049.

The quarter’s performance was also noteworthy because of its magnitude. The 10.6% first quarter return for the S&P 500 Index exceeded its average yearly return of 9.3% since 1927.

The table below shows the performance of major market indices for various time periods.

Total Returns: Major Indexes for Periods Ending on March 31, 2013

| Annualized | ||||||

| Index | Sector |

Quarter |

1-Year |

3-Year |

5-Year |

10-Year |

| S&P 500 | Large US Stocks |

10.6% |

14.0% |

12.7% |

5.8% |

8.5% |

| MSCI EAFE | Large Foreign Stocks |

4.4% |

7.8% |

1.9% |

-3.9% |

6.8% |

| BarCap AGG | US Bond Mkt. |

-0.1% |

3.8% |

5.5% |

5.5% |

5.0% |

Stock market performance is extremely sensitive to investors’ collective psychology. Investor sentiment can vary significantly, ranging from greed to fear. Strong markets can encourage greed, which can eventually produce bubbles, such as those experienced for technology stocks in the late-1990s and the housing market in the mid-2000s. The fear factor causes investors to panic and markets to crash. However, during most periods investor sentiment is more mixed. Although the investing industry’s most important disclaimer warns investors that “past performance is not a guarantee of future results,” it seems that for most market participants past performance heavily influences investment decisions.

Considering the tendency of investors to chase performance (or run from bad results), recent market highs have likely encouraged investors to shift money to U.S. stocks from underperforming assets. In addition, the advance to new highs has been a relatively smooth ride, with the VIX Volatility Index hitting its lowest level since early 2007. Also, as shown in the previous table, U.S. stocks have significantly repaired their historical track record. Considering these factors, investors now seem to have a more positive view of stocks as an asset class, especially in contrast to several years ago.

With the U.S. stock and real estate markets rebounding, a significant portion of household wealth (about $16 trillion or the size of national debt) that was lost during the Great Recession has been restored. Many investors who have deferred major expenditures, such as vehicles, homes, and vacations, will begin to spend more freely. The increase in the stock market, especially if sustained, is likely to have a positive impact on economic growth.

The strong performance of U.S. stocks has occurred in the face of a fairly long list of negative headlines. While a crisis has been averted regarding U.S. budget and debt issues, these matters remain largely unresolved. The expiration of the payroll tax cuts this past January and higher gasoline prices could have a negative impact on U.S. consumers. Europe is still mired in a prolonged recession, with continuing concerns over sovereign debt and political turmoil. The recent problems in the Cyprus banking sector have investors worried about the financial strength of other European banks. Nuclear threats from North Korea and Iran have added to global political instability.

Offsetting the bad news are generally positive trends for the U.S. economy. According to a recent Wall Street Journal survey of economists, GDP is expected to grow by 2.3% in 2013 (steady but not spectacular). The unemployment rate has declined to 7.7%, its lowest level since December 2008. Housing starts are at their highest point in 4 ½ years. The banking industry is well capitalized and profits are at their highest level since 2006. The Federal Reserve is still committed to keeping interest rates low until unemployment declines further.

During the first quarter, interest rates inched up slightly but remained at historical low levels. The yield on the 10-year Treasury bond ended the quarter at 1.85%, up slightly from 1.76% at the end of 2012. The Barclays Aggregate Bond Index, the broadest benchmark of the U.S. bond market, generated a small loss of -0.1% for the first quarter of 2013 and a positive return of 3.8% for the past 12 months. Fixed income investments, especially those with longer maturities, are unattractive due to the current low interest rate environment and the risk from a possible increase in rates over the next several years. (Morningstar recently reported that they found 300 bond funds that were holding stocks, probably due to higher yields, and lower interest rate risk).

Despite the general euphoria that comes with reaching new records for the major indices, some caution is warranted for U.S. stocks. Markets tend to move through various cycles, going from out-of-favor and undervalued, to fairly valued, to overpriced and speculative. After years of being undervalued due to the market crash in 2008-2009, stock prices now appear to be more fairly priced. The S&P 500 currently sells at a price which is 14.3 times its estimated earnings and has a dividend yield of 2.2%. By these metrics, the overall market appears to be appropriately priced, considering that global economic conditions are slowly improving, but significant risks remain. In other words, longer-term stock performance should be positive, but a correction along the way would not be unexpected.

While international stocks have significantly underperformed U.S. stocks for the past five years (as shown in the previous table) they appear to offer attractive potential for patient investors. The International Monetary Fund forecasts emerging market economies will grow at rate that is more than double the pace of advanced economies for each year of its forecast period of 2013 through 2017. By most valuation metrics, international stocks appear cheaper than U.S. companies. It would not be surprising to see foreign stocks, especially those exposed to fast growing emerging markets, close some of the performance gap over the next year.

Please contact us if you have any questions about the markets or your accounts.

— Tom Franks & Kirk Weiss

Bonds and Investment Risk

What is the risk of investing in bonds? This is a relevant question considering that investors have allocated a substantial amount of cash to bonds over the last several years. Investors’ move toward bonds was motivated by big drops and volatility in the stock market, bonds produced strong returns caused by the demand for bonds, and the Federal Reserve’s policy of lowering interest rates to historically low levels.

For the purposes of this article we are going to focus on bond fund risk. Most investors own bonds through mutual funds rather than individual bonds, and the two have different risk characteristics. Below are the risks associated with bond funds:

1. Liquidity Risk – How liquid is the bond fund? The less liquid the bonds that comprise the bond fund the higher the bid/ask spread. The higher the bid/ask spread the more a bond fund will pay for a bond purchase within the fund. These costs should lower the returns.

2. Credit Risk – Credit risk also known as default risk is based on the bonds of various companies/agencies/government, etc. that the fund owns. In other words, one could calculate the credit risk based on the collection of bonds the fund holds. Most bonds have credit risk ratings provided by one of the major ratings agencies (e.g., Standard & Poor’s, Moody’s). These agencies are paid by bond issuers, not investors.

3. Currency Risk – Currency risk could be an issue for foreign owned bond funds. Currency risk could be reduced if hedged properly. If un-hedged, typically when the U.S. dollar increases in value relative to foreign currencies the bond fund return will be reduced. However, if the U.S. dollar decreases the opposite is true [the bond fund return will increase].

4. Interest Rate Risk – This is the risk of rising interest rates and bond fund values. Interest rates and bond fund values have an inverse relationship. Therefore, if interest rates increase the value of the bond funds will decrease. One measure of a bond’s interest rate risk is its’ final maturity, i.e., the date when investors are to have their principal repaid. However, a better measure of a bond fund’s interest rate risk would be its duration. Duration takes into account the timing of all expected cash flows from the bonds in a portfolio, and can be interpreted as the percent change in price of the fund per a 1% change in overall interest rates. The higher a bond fund’s duration the more interest rate risk exposure it has. Below are three examples of bond fund duration and risk:

A. Vanguard Short-Term Bond Index Fund Duration = 2.7 years

B. Vanguard Intermediate-Term Bond Index Fund Duration = 6.5 years

C. Vanguard Long-Term Bond Index Fund Duration = 14.7 years

The longer the average maturity of a bond fund the higher the duration will be for the bond fund. For example, if interest rates [the 10 year Treasury note would be a good proxy] rose by 1% the Vanguard Intermediate-Term Bond Index Fund Value would drop approximately 6.5%. Considering interest rates are the lowest they have been in 60 years, interest rate risk should be on every bond fund investor’s radar. We have been in a 30 year bond bull market mainly because interest rates have dropped to almost zero [Federal Reserve discount rate]. Therefore, the most likely long-term direction for interest rates is upward. The Federal Reserve has stated that it will allow interest rates to rise as soon as unemployment returns to a more normal level, or if price inflation starts to increase at an unfavorable rate.

5. Sector Risk – There are many sectors in the bond asset class. Treasury, corporate, asset backed, municipal and high yield just to name a few. The question to ask is whether the bond sector being analyzed is overvalued or undervalued? For example, in our opinion, the U.S. Treasury sector is overvalued relative to other bond sectors. The yield to maturity -YTM [one measure of the future return of a bond/fund] for the Vanguard Intermediate-Term Treasury Fund is currently .90%, and the YTM for the Vanguard Intermediate-Term Investment Grade Fund is 2.1%. These two funds have approximately the same duration, but the Vanguard Intermediate-Term Investment Grade Fund’s YTM is 1.2% higher. The Vanguard Intermediate-Term Investment Grade Fund does have some credit risk and the Vanguard Intermediate-Term Treasury Fund has no credit risk [it is backed by the full faith of the U.S. Gov’t]. However, it appears based on the YTM the Treasury sector is over-valued.

Given the bond investing risks above, should you invest in bonds? We believe the exposure to bonds in one’s portfolio is a function of the goal, time horizon, risk tolerance and financial profile of each individual investor. In addition, the risks discussed above will be part of the equation regarding bond exposure. For most investors, bonds will be used to diversify the portfolio. In addition, there are many other factors that may influence bond prices/bond fund values. Below are just a few:

A. Sovereign Debt Values

B. Federal Reserve Policies

C. Global Macro Events

D. Global GDP Growth

E. Inflation

In conclusion, there is plenty of risk in the bond market. The bond exposure that an investor chooses depends upon a careful analysis using the risks that we mentioned above. Ultimately, the amount of bond exposure in one’s portfolio should be evaluated periodically based on several variables.

Kirk Weiss & Tom Franks

Market Commentary—4th Quarter, 2012

The stock market’s performance in the fourth quarter of 2012 was driven primarily by politics. After reaching a five-year high in September, the S&P 500 Index retreated by 7.7% by mid-November. This decline was largely attributed to President Obama’s reelection. His proposal for higher taxes on the wealthy was regarded negatively by many market participants. In addition, the so-called fiscal cliff – the automatic tax increases and spending cuts which were scheduled to take effect at year end if no budget agreement was reached – was coming into focus. It seemed as if each market move for the last six weeks of the year was linked to news concerning a fiscal cliff deal. On the second to last trading day the S&P 500 fell 1.1% on news of no progress, then on the last day of the year it rose 1.7% as a deal became likely.

While the fiscal cliff problem has been averted for the time being, probably the most significant benefit in dealing with this issue is that it brought attention to the federal budget deficit and related federal debt problems. A poll taken in November by the Washington Post-Pew Research Center indicated that 58% of Americans understood the fiscal cliff issue either “very well” or “fairly well.” The same poll showed that 62% believed that going over the cliff would have a negative effect on the economy. Bringing this issue to the forefront of the public’s consciousness increases the likelihood that politicians will address the underlying fiscal problems and arrive at a long-term solution.

U.S. gross domestic product (GDP), the sum of all goods and services, is $15.8 trillion. Of concern to many, GDP is now exceeded by the outstanding debt of the U.S., which is currently $16.4 trillion, or approximately $52,000 per citizen. The debt has risen sharply as the U.S. government has produced a budget deficit in excess of $1 trillion in each of the past four years. In the current 2013 fiscal year, the administration is projecting that the federal government will spend $3.8 trillion and collect $2.9 trillion in taxes, which will result in a deficit of $0.9 trillion. The budget deal which is currently in progress can be considered a step in the right direction, but it is not a complete solution.

Large company stocks, as measured by the S&P 500 Index, produced a slight loss in the fourth quarter, while maintaining most of its strong performance for the full year. The table below shows the performance of major equity and bond indices for various time periods.

Total Returns: Major Indexes for Periods Ending on December 31, 2012

|

Annualized |

||||||

|

Index |

Sector |

Quarter |

1-Year |

3-Year |

5-Year |

10-Year |

|

S&P 500 |

Large US Stocks |

-0.4% |

16.0% |

10.9% |

1.7% |

7.1%

|

|

MSCI EAFE |

Large Foreign Stocks |

6.2% |

13.6% |

0.5% |

-6.6% |

5.4% |

|

Barclays Cap. AGG |

US Bond Market |

0.2% |

4.2% |

6.2% |

6.0% |

5.2% |

Looking forward, it seems the most significant risk to global markets is that economic performance is highly dependent on the actions of politicians and bureaucrats. Decisions and actions regarding monetary, fiscal, and tax policies will have an important influence on future economic growth. The problems of budget deficits, large sovereign debt balances, high unemployment, and slow economic growth are considerable, but are solvable.

While these issues will take more time to resolve, the U.S. is well positioned to continue its economic recovery. In the third quarter, U.S. demonstrated relatively strong GDP growth of 3.1%. In November the unemployment rate declined to 7.7%, its lowest level since December 2008. In 2012, the housing industry added to GDP growth for the first time since 2005 and further contribution is expected in 2013. U.S. banks had their most profitable year since 2006. New sources of domestic oil and natural gas are contributing to economic growth and reducing the trade deficit. In November, the Chief Economist of the International Energy Agency predicted that the United States would overtake Russia as the leading producer of natural gas by 2015 and would pass Russia and Saudi Arabia to become the world’s largest oil producer by 2017. Interest rates and inflation remain at levels which support economic growth. The Federal Reserve’s current actions are intended to keep interest rates low and encourage investors to move money into riskier assets, such as stocks.

U.S. companies experienced modest earnings growth in 2012, as results from European operations detracted from overall performance. For companies comprising the S&P 500 Index, earnings grew an estimated 3.0% in 2012. The consensus forecast for 2013 is for roughly 11% earnings growth for the S&P 500 companies as the U.S. economy continues to recover and both Europe and emerging markets show improvement. With S&P 500 companies trading with an average price/earnings ratio of 12.9 on forward earnings and an average yield of 2.3%, stocks appear to be very reasonably valued compared to both historical norms and fixed income investments.

Interest rates remained at historical low levels in the fourth quarter. The yield on the 10-year Treasury bond ended the year at 1.76%, up slightly from 1.64% the end of September, and down from 1.88% at the beginning of the year. The Barclays U.S. Aggregate Bond Index, the broadest benchmark of the U.S. bond market, produced total returns of 0.2% for the fourth quarter and 4.2% for all of 2012. The current low interest rate environment, coupled with the likelihood that rates will eventually increase, makes fixed income investments relatively unattractive.

Last year marked the fourth consecutive year of positive returns for the S&P 500 Index. In three of those years, total returns exceeded 15%. While the pain of the 2008-2009 crash still seems fresh, the strong recovery since then clearly demonstrates the merits of adhering to a disciplined investment process and maintaining a long-term perspective. Considering that stocks are reasonably priced and the economy continues to show signs of improvement, equities appear to offer very attractive return potential going forward.

Please contact us if you have any questions about the markets or your accounts.

— Tom Franks & Kirk Weiss

Market Commentary–3rd Quarter, 2012

Stock markets generated strong returns in the third quarter of 2012, with major equity indices rising in excess of 6%. The S&P 500 Index produced total returns of 6.4% for the third quarter and has gained 16.4% for the year-to-date period, as shown in the table below.

Total Return Performance of Major Indexes for Periods Ending on September 30, 2012

|

Annualized |

|||||||

|

Index |

Sector |

Quarter |

YTD |

1-Yr |

3-Yr |

5-Yr |

10-Yr |

|

S&P 500 |

Large US Co’s |

6.4% |

16.4% |

30.2% |

13.2% |

1.1% |

8.0% |

|

MSCI EAFE |

Large Int’l Stocks |

6.1% |

7.0% |

10.0% |

-0.9% |

-8.1% |

5.4% |

|

BarCap AGG |

US Bond Mkt. |

1.6% |

4.0% |

5.2% |

6.2% |

6.5% |

5.3% |

The market’s recent performance is in sharp contrast to that of last year’s third quarter, which produced a 13.9% loss in the S&P 500 Index. It’s notable that most of the same problems that spooked the market last year are still present. U.S. economic growth is sluggish with unemployment over 8 %, most of Europe is in a recession with a number of countries facing major debt problems, and China’s growth is below expectations. In addition, in the U.S. there is significant uncertainty relating to the upcoming presidential election and a potential “fiscal cliff” (automatic spending cuts and tax hikes) that could go into effect at year end. However, the S&P 500 generated returns of 30.2% over the past 12 months, substantially outpacing international markets.

With its recent strong performance, the S&P 500 index ended the quarter about 8% below its all-time high which was set in October 2007 (see below). While approaching a new peak might make some investors nervous, it is important to note that estimated 2012 earnings for S&P 500 companies are expected to exceed 2007 earnings by 23%, clearly indicating that stocks are very reasonably valued compared to five years ago. This record level of corporate earnings also demonstrates that companies have adapted their business models so that they can deliver strong performance even when overall economic growth is modest.

The strong performance of the U.S. stock market over the past year reflects a change in perspective, since most of the same problems still exist. At this time last year, market values had fallen significantly, reflecting concerns that a global recession was on the horizon and that measures taken by government bodies were largely ineffective. In contrast, the market’s recent advance has been primarily attributed to optimism over actions taken by government officials to reinvigorate growth. Mario Draghi, president of the European Central Bank (ECB), stated that the ECB would do “whatever it takes” to preserve the euro and stabilize the Eurozone. The U.S. Federal Reserve initiated another round of bond buying (quantitative easing) intended to keep interest rates low, encourage economic growth, and reduce unemployment. The Chinese government announced a $158 billion infrastructure program intended to help stimulate the domestic economy.

Lower market volatility may encourage some investors to shift funds to equities, helping to support the recent rally. In last year’s third quarter, markets were extremely volatile with the S&P 500 Index moving an average of 1.5% higher or lower from its previous day’s closing price. In the third quarter of 2012, the average daily move was just 0.5%, a 67% reduction in volatility from the prior year period. In last year’s third quarter there were 19 days when S&P 500’s daily move was more that 2%, compared to just one day in this year’s third quarter. In last year’s third quarter there were 8 days when the S&P 500 advanced or declined by more than 3%. There has not been one day in all of 2012 with a 3% move in the index. Since investors equate market volatility with risk, lower volatility makes equities more attractive from a risk versus reward perspective.

The Federal Reserve’s current aggressive bond buying program should also support the stock market. The Fed’s primary goal of buying government bonds is to keep interest rates low to reduce the cost of borrowing for corporations and individuals. More borrowing should lead to more spending and consequently greater economic growth. A secondary goal is to inflate asset prices. Since yields for fixed income investments are extremely low, it is hoped that money will be shifted from fixed income to higher returning assets such as equities and real estate. Higher asset prices produce a wealth effect – when people feel richer, they spend more.

Interest rates remained near record low levels throughout the third quarter. The yield on the 10-year Treasury bond ended the third quarter at 1.64%, virtually unchanged from the 1.66% yield at the end of June, and down from 1.87% at the beginning of the year. These historically low rates reflect investors’ pursuit of “safe assets” as well as demand from the Federal Reserve’s bond buying program. Recent auctions of Treasury Inflation-Protected Securities, or TIPS, clearly demonstrate that conservative fixed income investors are willing to accept returns that are less than the rate of inflation. In September, the Treasury sold 10-year TIPs with a yield of negative 0.75%. It was the fifth consecutive auction of 10-year TIPS with negative yields.

The previous paragraph includes the words “safe assets” in quotes to highlight the point that fixed income investments, which are generally regarded as safe, could actually possess a high degree of risk. An increase in interest rates (currently viewed as unlikely any time soon) would cause a decline in the value of fixed income securities. And while most still consider U.S. Treasury securities a safe bet, despite the downgrade from AAA status in 2011, credit risk for U.S. government securities could increase if officials do not address the rapidly increasing U.S. debt burden. To mitigate these risks, portfolios under management have relatively short average maturities and are diversified across various fixed income market sectors.

Please contact us if you have any questions about the markets or your accounts.

— Tom Franks & Kirk Weiss

Market Commentary– 2nd Quarter, 2012

Stock markets around the globe stumbled in the second quarter, primarily due to sovereign debt concerns in Europe and signs of slowing economic growth in the U.S. and major emerging markets. From its April 2 peak to its low point on June 1, the S&P 500 Index fell by 9.9%. Smaller companies and foreign stocks suffered larger corrections as investors perceived these sectors as having more exposure to a weakening economic environment. A strong 4.0% advance in June for the S&P 500 helped to cut the quarter’s losses.

International stock markets suffered the greatest damage during the quarter as Europe’s economy continued to stall and interest rates for Spanish and Italian government bonds rose to levels that would make it difficult to finance their national debt. While still growing, emerging market economies slowed from the rapid pace of the last several years. In particular, China has been slowing the last 6 months and there is concern that their real estate markets are overvalued.

The table below shows total returns for major stock and bond indices for various time frames. The dismal performance of developed international markets mainly reflects stagnant economies in Europe and Japan. Demand for Treasuries pushed the yield on the 10-year Treasury bond down to 1.66% at the end of June from 2.22% at the end of March and down from 3.16% one year ago. The BarCap Aggregate Bond Index, which measures the performance of the taxable bond market, generated 2.1% returns during the quarter.

Total Returns: Major Indexes for Periods Ending on June 30, 2012

| Annualized | |||||||

| Index | Sector | Quarter | YTD | 1-Year | 3-Year | 5-Year | 10-Year |

| S&P 500 | Large US Co’s |

-2.8% |

9.5% |

5.5% |

16.4% |

0.2% |

5.3% |

| MSCI EAFE | Large Int’l Stocks |

-8.4% |

0.8% |

-16.7% |

2.9% |

-8.9% |

2.4% |

| BarCap AGG | US Bond Mkt. |

2.1% |

2.4% |

7.5% |

6.9% |

6.8% |

5.6% |

During the quarter, equity markets were primarily impacted by news out of Europe. Investors worried about the ability of several European countries to repay their sovereign debt and that a weak European economy could trigger a U.S. recession. If this scenario sounds familiar, it is a virtual repeat of the conditions that were present in each of the past two summers. And there is some strong likelihood that investors will be worrying about these same concerns next summer. European sovereign debt issues have helped to produce three market corrections in three years. As various bailout programs are announced, the concerns recede and the markets rally, only to falter again when the problems reappear. The European officials have so far failed to find a comprehensive plan to solve the root causes of the crisis. Europe is in recession. Greece is effectively in a depression, and the risk of Spain & Italy becoming overwhelmed by the crisis remains high. At the end of the day there is no easy or painless solution to Europe’s problems, which will create more volatility moving forward. This situation has caused many equity investors to lose patience, seeing their investments rise and fall with each new headline.

Most of the short-term movement of the stock market is driven by the news of the day. Investors that adhere to a marketing timing strategy attempt to move in and out of stocks based on the expected outcome of near-term events. Recent developments demonstrate how difficult it is to predict the future and also that conventional wisdom is often wrong. Here are some examples:

U.S. Treasuries were downgraded by S&P credit rating services last July from their AAA rating. Normal expectations would be that interest rates would rise on these securities which are now deemed to be riskier. However, the interest rate on the 10-year Treasury bond fell by almost 50% since the downgrade. We believe that the drop in the 10 year treasury rate was mainly driven by the European debt crisis which caused equity market volatility as mentioned above.

Another credit rating agency, Moody’s, announced in February that it was reviewing the credit worthiness of 100 banks around the world. In June, Moody’s downgraded five of the six largest U.S. banks. Ironically, the Federal Deposit Insurance Corporation recently reported that the U.S. banking industry earned a $35.3 billion profit in the first quarter of 2012, its best quarter since 2007. It was the 11th consecutive quarter that bank profits increased compared to the prior year. The financial sector was a top performing industry sector in the first half of 2012, with total returns of roughly 11%. Most likely, the financial sector will have to participate if the stock market continues to rise.

The healthcare care law was upheld by the Supreme Court in a ruling that shocked almost all observers. Chief Justice John Roberts, voting with the four liberals on the court, upheld the individual mandate as a tax, rather than a penalty – an interpretation that no one expected. The ruling caused significant movement in a number of stocks, based on how they were perceived to be impacted by the law going forward.

Just a few months ago, experts were predicting $5 per gallon gasoline for this summer as the price of oil approached record levels. Instead, according to AAA, gasoline is currently selling at a national average of $3.34 per gallon. This price reduction is primarily due to a global economic slowdown which has lowered demand for oil, and the easing of some political tensions in the Middle East.

These surprises should teach investors it is almost futile to predict short-term events. As the second half of the year progresses, there is no doubt the market will fret about the outcome of the U.S. presidential election, the fiscal cliff (the expiration of tax cuts & scheduled government spending cuts), and the ongoing problems in Europe. In addition, we are still facing several headwinds including high unemployment, the debt ceiling issue, and a still unhealthy housing market. Stocks are likely to exhibit a high level of short-term volatility, due to the many uncertainties and because, more so than in most periods, economic prosperity is dependent on the actions of government officials.

With so many negative headlines, it is often possible to lose sight of the long-term positives for equity investments. However, stocks have excellent long-term return potential when considering that company valuations are very attractive (low price/earnings ratios and high dividend yields), corporate earnings are rising (albeit at lower levels), inflation is low, interest rates are low, corporate and family balance sheets have improved significantly, housing and auto sectors are recovering, and the banking crisis has passed. In addition, alternative investments, such as money market funds and bonds appear to offer unattractive long-term returns.

Sometimes we are asked “Should we sell and move to cash?” As mentioned above, selling and moving to cash is not a prudent strategy. When do you move to cash? When do you move back to equities? Market timing is nearly impossible, and very few people get it right consistently. Furthermore, let’s not lose sight of the fact that we should and do have a long-term focus when managing our investment portfolios. Because we are invested for the long-term we need to have patience. Unfortunately moving forward the markets will be volatile due to all the issues the U.S. and the global markets are facing. When it comes to long-term investing success, patience is a virtue.

We continue to recommend that investors diversify across all major asset classes [equities, bonds, short-term, real estate & commodities]. In addition, based on periodic investment analysis, make adjustments to the portfolios as necessary. The current investment markets are complex and challenging. This is a true “advisor” environment.

Please contact us if you have any questions about the markets or your accounts.

— Kirk Weiss & Tom Franks

Market Commentary—1st Quarter, 2012

Equity markets rallied strongly in the first quarter of 2012 as the US economy continued to show signs of improvement and fears of a debt crisis in Europe subsided. The S&P 500 Index generated a 12.6% total return for the quarter. It was the best quarterly performance since the third quarter of 2009 and the strongest first quarter since 1998. It was the second quarter in a row which produced double-digit gains. In the past six months the S&P 500 has risen 25.9%. However, those gains primarily represent a recovery from bear market territory. As can be seen in the table below, returns for the one-year period are single digit for the S&P 500 and negative for international stocks.

Total Returns; Major Indexes for Periods Ending March 31, 2012

| Annualized | ||||||

|

Index |

Sector |

Quarter |

1-Year |

3-Year |

5-Year |

10-Year |

|

S&P 500 |

Large US Co’s |

12.6% |

8.5% |

23.4% |

2.0% |

4.1% |

|

MSCI EAFE |

Large Int’l Stocks |

10.0% |

-8.8% |

13.7% |

-6.3% |

3.0% |

|

BarCap AGG |

US Bond Mkt. |

0.3% |

7.7% |

6.8% |

6.3% |

5.8% |

The mixed performance and wild swings in equity prices over the last 12 months primarily reflect disappointing economic results for most major economies. According to the Wall Street Journal Economic Forecast Survey, at this time last year economists were forecasting US GDP growth of 3.5% for 2011. Actual growth was just 1.6%. European Union (EU) GDP grew at 1.5% in 2011, with Germany’s 3.0% growth (20% of EU GDP) helping to offset weakness in the United Kingdom (+0.8%), Italy (+0.4%), Spain (+0.7%), Greece (-6.8%), and Portugal (-1.6%). Emerging market economic growth slowed as well. According to the International Monetary Fund, emerging market GDP growth declined from 7.3% in 2010 to 6.4% in 2011.

The recovery in stock prices from the lows of last fall seems to reflect that risk of another global financial meltdown has been significantly reduced by actions taken to resolve the European sovereign debt crisis. However, numerous other concerns persist. Global economic growth remains weak and unemployment in most western economies is above acceptable levels. Government deficits and debt remain high. Rising oil and gasoline prices pose a threat to further economic growth. Geopolitical tensions, especially related to Iran’s nuclear program and a possible preemptive attack by Israel, represent a risk to markets.

One of the other risks facing the US economy, is a “fiscal cliff” scheduled to occur in 2013, from the combination of the expiration of Bush-era tax rate cuts, and the imposition of automatic spending cuts, stemming from debt-ceiling negotiations last year. It is likely that these measures will be modified, but probably not until after the fall elections, due to the political disagreement over tax increases versus expense cuts. The fall election is expected to be contentious as the two political parties disparage each other, competing for voter support of their vision as to how to best manage the federal budget.

One of the more positive trends in the first quarter was a significant reduction in volatility – especially negative volatility. During the last five months of 2011 the S&P 500 Index closed 2% higher or lower than the previous day’s closing price on 30% of all trading days. In the first quarter, there were no days when the market moved more than 2%. There were just five days when the market moved by more than 1% – and four of those days the market closed higher. Because most investors see volatility as a significant investment risk, the lower volatility likely helped to bolster investor sentiment. In addition to lower volatility supporting the market, we see the potential for three other major trends to provide positive market support over the near and long term.

Higher stock prices provide a positive wealth effect for investors, which should be stimulative for the economy. The Great Recession and collapse of the stock market had a negative wealth effect. Many investors deferred purchases as their portfolios shrunk. As investors see their net worth advance, they are more likely to replace an old car, buy a home, go on a vacation, or make a major purchase. In addition, higher stocks should produce higher tax revenues related to capital gains and allow more individuals to retire (opening up jobs in the work force).

As investors regain faith in the stock market, money is likely to shift from fixed income and money market investments back into equities. With the 10-year Treasury bond yielding just 2.2% and money markets funds yielding close to 0%, investors are likely to seek out higher returns in equities. The Investment Company Institute reports that there is currently $2.6 trillion invested in money market mutual funds – all this money earning next to nothing.

Housing prices declined for the fifth consecutive year in 2011. The current economic recovery has occurred without any help from the housing industry. Economists are currently forecasting flat housing prices for 2012. A stabilization or modest increase in housing prices should have an extremely positive impact on the economy and stock market.

Fixed income investments generated modest returns in the first quarter as interest rates nudged higher. The BarCap Aggregate Bond Index, which measures the performance of the taxable bond market, generated a 0.3% return during the quarter. The BarCap Municipal Bond Index produced a 1.8% return. The yield on the benchmark 10-year Treasury bond increased from 1.88% to 2.22% during the quarter. Fixed income investments will likely suffer as the economy and stock market recover. Having served as a safe haven during a period of slow growth and high uncertainty, money is likely to shift out of this investment class as investors accept greater risk for the possibility of higher returns.

Clearly, the general public is still hesitant to put money into the stock market considering the weak performance of the last 5 and 10-year periods and lingering risks to the global economic recovery. However, this caution has kept equity investments in a reasonably-valued range, which should allow for attractive returns for investors with a long-term focus.

Please contact us if you have any questions about the markets or your accounts.

—Tom Franks & Kirk Weiss

Market Commentary—4th Quarter, 2011

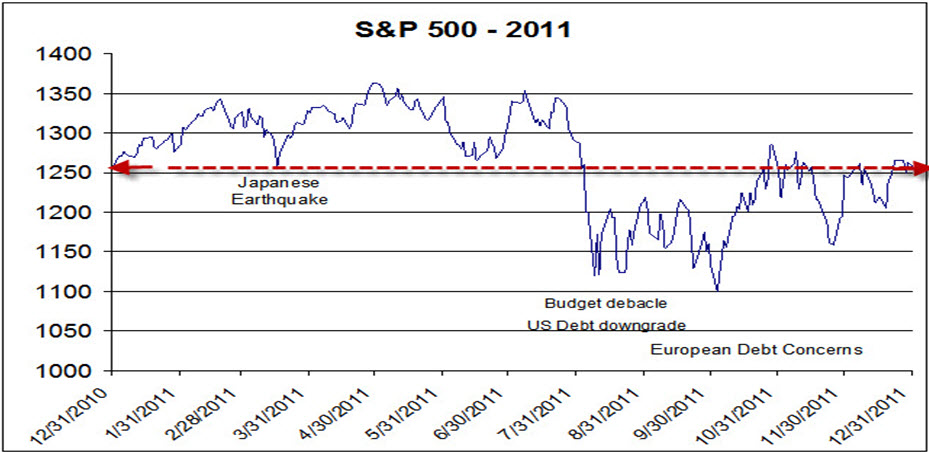

The US stock market, as represented by the S&P 500 Index, amazingly closed 2011 at almost the exact level that it began the year. As the graph below indicates, stocks spent most of the first half of 2011 in positive territory. In March, markets were initially jolted by the Japanese earthquake and tsunami, but then began to recover as the damaged reactors came under control. However, the dysfunctional political process in the U.S. regarding the budget and debt ceiling in July led to a downgrade of U.S. debt and an almost 20% decline in stock prices.

At the same time, the sovereign debt crisis in Europe caused fears of another “contagion”, in which defaults could potentially spread, from country to country, and involve several European banks. When the market bottomed on October 4, many investors believed that another global recession could be on the horizon.

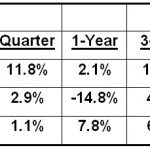

As shown in the following table, the S&P 500 Index had a small total return of 2.1% in 2011, which was generated by dividends. However, most major stock indices showed negative total returns in 2011.

Total Returns; Major Indexes for Periods Ending December 31, 2011

| Annualized | ||||||

|

Index |

Sector |

Quarter |

1-Year |

3-Year |

5-Year |

10-Year |

|

S&P 500 |

Large US Co’s |

11.8% |

2.1% |

14.1% |

-0.3% |

2.9% |

|

MSCI EAFE |

Large Int’l Stocks |

2.9% |

-14.8% |

4.5% |

-7.4% |

2.0% |

|

BarCap AGG |

US Bond Mkt. |

1.1% |

7.8% |

6.8% |

6.5% |

5.8% |

In particular, international markets were down sharply due to the economic problems in Europe. Small company stocks and emerging market securities suffered even more as investors shifted from higher to lower risk assets. Concerns over a slowing Chinese economy added to selling pressure. However, U.S. markets enjoyed a strong recovery in the fourth quarter, as fears of a recession receded due to better-than-expected economic performance. GDP, employment, and housing data showed signs of improvement.

Ironically, even though the S&P 500 Index had little net change over 2011, it was one of the most volatile years on record. It was like a roller coaster with numerous drops, dips, and inversions that ended up at the same place it started – but left most of its riders nauseous. From its high point on April 29 to its lowest level on October 4, the S&P 500 declined 19.4%. The headlines in the summer and fall regarding U.S. and foreign debt problems caused markets to be extremely skittish. Since August 1, the S&P 500 Index closed more than 2% lower or higher than its previous day’s closing price on 32% of all trading days. It moved more than 3% from its previous day’s close on 11% of all trading days.

More so than in most years, economic circumstances were being dictated by politicians and bureaucrats rather than market forces, both in the U.S. and overseas. The actions and inactions by Congress, the Federal Reserve, the European Central Bank, and politicians across Europe created an extreme level of uncertainty for investors. Uncertainty usually equates to risk and greater market volatility.

While negative for stocks, this heightened sense of risk was positive for the U.S. government bond market. As investors looked to escape foreign bonds and the volatile stock market, they moved money into U.S. government bonds. This occurred despite a downgrading of the U.S. credit rating, the lack of a solution to U.S. fiscal problems, and the ever expanding federal deficit. Demand for government bonds pushed down the interest rate on the 10-year Treasury Bond to 1.88% at year end from 3.30% at the end of 2010. The BarCap Aggregate Bond Index, the broadest benchmark of the U.S. bond market, produced a total return of 7.8% in 2011.

There are a number of factors that should contribute to positive stock market performance in 2012. Stocks are cheap by historical standards, corporate earnings are at record levels and are expected to increase, corporate balance sheets are in great shape, and stocks’ dividend yields compare favorably with interest from bonds. However, these factors are primarily offset by serious fiscal problems facing the governments of most developed countries. In addition, many investors have lost interest in equities due to their underperformance during the past ten years.

It is likely that it will take a while for the global economy to regain its momentum, although 2012 has begun well, as of this writing. Corporations have adapted their business models to deal with the less robust environment and are prospering. In this regard, investors with patience, investment discipline, and a long-term perspective are likely to be rewarded as the economy gradually recovers and confidence returns to equity investing.

Please contact us if you have any questions about the markets or your accounts.

—Tom Franks & Kirk Weiss

Market Commentary–3rd Quarter, 2011

Concerns over slowing economic growth across the globe produced a significant correction for virtually all major stock markets in the third quarter. The S&P 500 Index lost 13.9% during the third quarter and has lost 17.1% from its 2011 high which occurred on April 29. It was the worst third quarter performance for the S&P 500 since 1928, according to Bespoke Investment Group. Foreign stocks, as represented by the MSCI EAFE International Index, had a bigger third quarter loss of 19.6%.

Total Return Performance of Major Indexes for Periods Ending on September 30, 2011

| Annualized | |||||||

|

Index |

Sector |

Quarter |

YTD |

1-Year |

3-Year |

5-Year |

10-Year |

|

S&P 500 |

Large US Co’s |

-13.9% |

-8.7% |

1.1% |

1.2% |

-1.2% |

2.8% |

|

MSCI EAFE |

Large Int’l Stocks |

-19.6% |

-17.2% |

-12.0% |

-4.0% |

-6.1% |

2.4% |

|

BarCap AGG |

US Bond Mkt. |

3.8% |

6.4% |

5.3% |

8.0% |

6.5% |

5.7% |

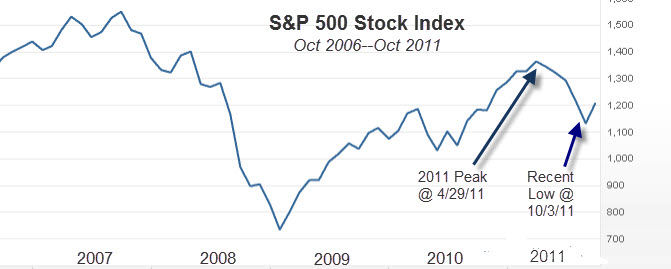

The chart of the S&P 500 below shows that the recovery that began in 2009 has had some setbacks, and the recent quarter was one of the most significant.

While the global economy was struggling going into the third quarter, the inability to favorably resolve budget and debt problems in both Europe and the U.S. has seemed to erode consumer, business, and investor confidence. The Greek debt crisis remains in the news on a daily basis, currently without a solution. The failure of the U.S. Congress to address short and long-term budget issues in July, compounded by a rating downgrade of US debt by Standard & Poors were the major contributors to the U.S. market’s steep decline. The problems in reaching an agreement for raising the debt ceiling highlighted the ineffectiveness of Congress in dealing with important economic issues. More so than in most time periods, the global economy is currently dependent on politicians and bureaucrats to act forcefully and intelligently. Policy decisions currently in the hands of government officials will have a significant impact on the global economy over the next year.

The steep market correction also reflects that many investors now believe that the U.S. has either entered another recession, or will shortly enter one. There is an old Wall Street adage which says that the market has predicted 9 of the last 5 recessions. In a number of instances, the market has declined in anticipation of a recession; however, many of those recessions never materialized. For example, in the summer of 2010 the market suffered a 15.9% decline on fears of a double-dip recession, which never occurred. The economy continued to expand and the market recovered strongly. The stock market also suffered major corrections in 1998 and 2002 due to fears of recessions which never happened. Investors are now more skittish after the major market decline in 2008-2009, and head for the exits if they sense a possible, significant downturn.

Unfortunately, the gains from the bottom of last year’s market correction have largely evaporated as recession fears are again unnerving investors. This pattern of short-term volatility combined with poor long-term returns has lead many investors to believe that market-timing is a viable strategy for generating returns – or at least avoiding losses. However, this strategy is fraught with danger, since predicting the events which cause market movements is virtually impossible.

A study by Dalbar for the 20 year period ending 2009 concluded that retail investors trail the market returns by 5% per year, mainly due to selling when prices start to drop, and buying when they rise, i.e., trying to time the market.

Even some institutional investors try market timing and come up short. Locally, The Pittsburgh Business Times August 2011 issue documented the City of Pittsburgh Pension board’s failed attempt to time the market. In August 2010, when the market was down and fears of a recession loomed, the board unanimously voted to sell all of its stock holdings on the advice of its investment consultants. At the time, the plan was invested 60% in stocks and 40% in bonds. After selling all of its equities last summer, the plan continued to hold no stocks until March 1, 2011. By then the market had recovered significantly and recessionary fears had faded. Between March 1 and March 31, 2011, the plan reestablished a 60% exposure to stocks. Of course, as is now apparent, the market timing strategy resulted in selling low and buying high. The Pittsburgh Business Times estimates that the strategy cost the pension plan up to $35 million, compared to having remained at a 60% stock/40% bond mix through the entire period.

Much of the selling that occurs during a market correction is based on emotion. After seeing a decline in market values, some investors become fearful that further losses will occur. This fear, and in some instances panic, will result in selling without any regard to the underlying value of the investments. For long-term investors who focus on the value of companies, there is no reason to sell undervalued positions, and if cash is available, a market correction usually presents an opportunity to buy. For example, renowned investor, Warren Buffett, commented to Bloomberg news that he had purchased $4 billion of equities during the third quarter as the lower market presented better values.

During market corrections, it takes a stronger resolve on the part of long-term investors to stick with an investment strategy. With the decline in market value, long-term performance is eroded and investors lose confidence in equities as a long-term investment vehicle. However, despite the negative news, there are a number of reasons for owning equities:

- Stocks appear to be undervalued compared to their long-term earnings potential, dividends, and other valuation metrics. For example, the S&P 500 is trading at just 11.0 times forward earnings, significantly below its historical average.

- Earnings for U.S. companies are at record levels. While the S&P 500 Index trades at approximately the same level it was 10 years ago, earnings for the index have increased from $38.85 in 2001 to an estimated $98.02 for 2011.

- Cash on corporate balance sheets is at record levels; balance sheets are in great shape. Treasury Strategies, a consulting firm, reported that corporate cash now stands at $2.05 trillion, 4.5% higher than the previous quarter, and 46% higher than in March 2009.

- Stocks now generate more income than bonds. The dividend yield of the S&P 500 is currently 2.39%. The yield of the Barclays Capital U.S. Aggregate Bond Index is 2.35%. The yield on the 10-year Treasury bond is 1.71%.

- Expectations for stocks and the economy have declined significantly in recent months. If a recession does not develop, stocks are likely to rally, as they did is the fourth quarter of 2010.

- Politicians are likely to take actions that will boost stock prices. We are currently in the third year of the presidential cycle. The third year is by far the best performing year of the four-year presidential cycle, probably due to actions intended to stimulate the economy and markets prior to the presidential election in the fourth year. There has not been a negative third year since 1939. Since 1930, the S&P 500 Index has average 18.4% in the third year of the presidential cycle.

Economic conditions are weak in Europe and the U.S. and another recession is possible. Consumer demand is soft because individuals are saving rather than borrowing and spending. Banks are no longer lending to unqualified borrowers. Unemployment is high in many areas due to layoffs in the bloated public sector. Long-term funding and spending issues regarding entitlement programs are finally being addressed. The road to a stronger economy and higher stock prices is likely to be unpredictable with many ups and downs.

However, there are many constructive factors in place which should eventually lead to a positive outcome for patient, long-term oriented investors. (As of this writing, the S&P is up about 6% since the start of October, which is a positive sign that a market recovery is possibly underway.)

Please contact us if you have any questions about the financial markets or your accounts. If current market volatility is uncomfortable for you, you may want to consider a more conservative investment objective. This will reduce your long-term expected return, but may be the most appropriate action given your risk tolerance and future goals. We have developed a new questionnaire to help you make this decision.

—Tom Franks & Kirk Weiss