Investment Philosophy

We believe a long term approach provides the greatest probability of success in investing. We manage risk by using significant diversification. A long term perspective means lower portfolio turnover which translates into lower costs and lower taxes (in taxable accounts).

We believe a long term approach provides the greatest probability of success in investing. We manage risk by using significant diversification. A long term perspective means lower portfolio turnover which translates into lower costs and lower taxes (in taxable accounts).

Numerous studies have shown that asset allocation (how assets are distributed among various classes of investment vehicles – e.g. stocks, bonds, cash, etc.) is the most important determinant of risk and return. Therefore we consult with clients to determine their investment goal, time horizon and risk tolerance and design the appropriate asset allocation.

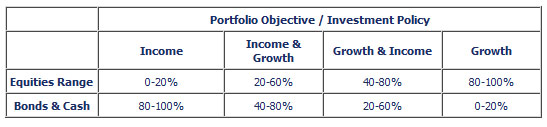

Clients sign an Investment Policy statement to confirm the objective that should be pursued by the portfolio manager. The primary difference between account objectives is the percentage of the portfolio invested in equities (common stocks). Equities have the greatest return potential, but also the greatest level of volatility and risk of loss. The table below shows the major asset allocation guideline/policy for each type of portfolio objective.

The number of securities (mutual funds, exchange traded funds (ETFs), individual securities, etc.) purchased in an account is related to the dollar size of the account. Smaller accounts will hold only a few mutual funds. Most funds contain 20-500 individual securities and therefore have much inherent diversification.

Larger accounts will hold more funds. The number and type of funds will vary by client risk preferences and investment goals. In general, if we are using funds, we prefer to use Exchange Traded Funds (ETFs) and Index Funds due to their lower costs. ETFs are also easier to buy and sell, and do not have restrictions such as early redemption fees.

If the account approaches or exceeds $100K, we may start using individual securities, depending on the client. Individual stocks and bonds have the greatest return potential and risk.

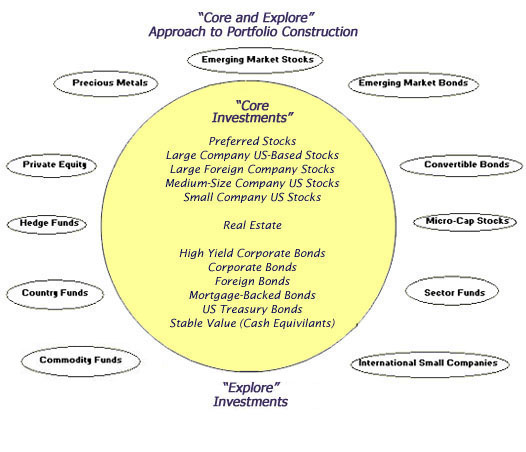

We use an approach similar to that used by major pension and endowment funds, termed “Core and Explore”. This means that half or more of the portfolio is invested in broad index-like funds that will track the major market averages at low cost. The balance of the portfolio is invested in higher return /higher risk investments that should outperform market averages over the long term. The diagram below illustrates this approach.

We do not try to “time” the overall stock market. Numerous studies have shown that the market is essentially impossible to time consistently. Some market strategists have become famous for a major, correct call before a major market downturn or uptrend. However, most of the time luck is involved, which is a real factor in investing. One saying in the investment business is that “even a blind squirrel will find an acorn sometime.”

We do think value can be added through sector analysis and individual security selection. Sectors tend to have more persistent trends than the overall market, and we identify the best individual securities in attractive sectors.

Periodically we revisit our client’s goal, risk tolerance and time horizon and make the necessary changes to their asset & sector allocations. This periodic review could result in rebalancing (the process of transferring investments to meet the target asset allocation) the securities within the portfolio. We may also sell or buy a security within the portfolio due to fundamental changes (risk/return characteristics) of that security.

Regarding moral screening, we attempt to avoid any investments that may conflict with Christian values. The typical “sin” stock categories are companies that profit from tobacco products, gambling, pornography, or abortion. We will avoid directly investing in any stocks of this type of company. (However, sometimes, it is very difficult to completely avoid these companies since we use broad index funds, which may have a small holding in some of these types of companies). We also avoid investing directly in Chinese or Russian securities. These countries are known to have unethical business practices and a lack of freedom of speech, and to persecute Christians.