Market Commentary—1st Quarter, 2011

Let’s say you possessed a crystal ball which could foretell significant world events months before they happened. At the beginning of the year, the crystal ball predicted there would be major political uprisings in North Africa and the Middle East as well as the ouster of long-time dictators. It foretold a civil war in Libya, a halt to all Libyan oil exports, and the US entering the war on the side of the rebels. It forecasted a 17% spike in the price of oil, a sharp decline in the US dollar, a major 9.0 earthquake and tsunami devastating Japan, and a nuclear and environmental disaster.

If an investor knew of these extraordinary events months before they occurred, it is likely that he or she would have been inclined to sell their equity holdings. The stock market typically does not react well to negative news. However, in the face of major unsettling events, the stock market, as measured by the S&P 500 Index, had its best first quarter since 1998, producing returns of 5.9%.

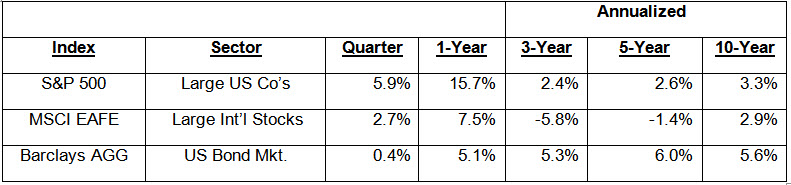

Total Return Performance of Major Indexes for Periods Ending on March 31, 2011

As can be seen in the preceding table, with recent performance, the S&P 500 now displays positive returns for the current quarter, 1, 3, 5 and 10-year periods. It is the first quarter-end since September 30, 2007 that shows positive returns for all time frames. While the 3, 5, and 10-year returns are below the long-term average for stocks of almost 10%, moving into positive territory will go a long way toward restoring investor confidence in equities. Many investors who had moved money into low-returning fixed income securities as a safe haven over the last several years are now more comfortable investing in stocks.

To explain how the market rose in the face of all of the pessimistic news is almost as difficult as trying to predict the stock market’s next move.

The strong stock market performance is related to a recovering US economy, monetary stimulus by the Federal Reserve, a weakened US dollar which spurs US exports, improving job market and consumer confidence, rising corporate earnings, and strong global demand. Fortunately, the many, diverse factors supporting the stock market give it strength to avoid being derailed by recent negative events.

The last quarter taught us once again, it is virtually impossible to predict future events and their impact on the stock market

While the market has moved beyond the fears of a double-dip recession that spooked it in the middle of 2010, most of last year’s nagging problems still exist. Several European countries struggle with massive debt problems, the US faces large budget deficits at the federal, state and local levels, and the housing industry shows almost no signs of recovery.

Fixed income investments produced modest returns in the first quarter as interest rates inched higher. The BarCap Aggregate Bond Index, which measures the performance of the taxable bond market, generated 0.4% return during the quarter. The yield on the benchmark 10-year Treasury bond rose from 3.30% to 3.45% during the quarter. Most observers believe that the Federal Reserve’s purchase of Treasury securities as part of its current quantitative easing program has resulted in maintaining a low interest rate environment (as the Fed intended). There is some concern that interest rates will begin to rise when this program ends in June. Rising interest rates generally result in lower prices for fixed income securities.

The events of the last three years have been difficult for many Americans. Almost everyone suffered in some way – the loss of a job, the loss of value in their home and investment accounts, and the general anxiety caused by a global financial crisis. While prosperity has not returned for everyone, most recognize that the current trend is showing steady improvement. Although significant problems need to be resolved, further progress should contribute to positive results for investors.

Please contact us if you have any questions about the financial markets or your accounts.

–Tom Franks & Kirk Weiss