Our Services

- I.) We manage the majority of client assets via separate accounts, which provide greater flexibility in customizing portfolios and managing taxes (in taxable accounts). We manage accounts for individuals or institutions. The following are descriptions of the types of accounts we manage:

Globally-diversified accounts: using mutual funds, exchange-traded funds (ETFs), stocks, and bonds. We frequently use exchange traded funds (ETFs) or index funds, which saves clients money. We do not use any funds that have a load (selling charges by the mutual fund company), and look for below average expense ratios (fund management fees). When appropriate, we may incorporate alternative investments (private equity, hedge funds, precious metals, etc.) to reduce portfolio risk.

*** ECM utilizes this approach in taxable accounts & non taxable accounts (IRA’s)

Customized portfolios of individual securities: For interested clients we can customize a stock portfolio that suits your specific preferences in terms of market capitalization (company size/ risk) number of securities, and moral screening.

Third Party Accounts: If you are an advisor seeking a separate account manager for equities, we will work with you and your client to create a portfolio that suits your clients’ needs and preferences.

Management of Employer-Sponsored Retirement Accounts: 401(k), 403(b), 457 Plans

We will analyze the client’s plan and investments options. Based on our analysis, we will recommend the proper asset allocation and investment selections. Periodically, will we conduct a review of the client’s plan and make the necessary changes based on the client’s retirement goals & risk level. In general, a client must have a separate account under management before we will manage an account of this type. We can also assist clients roll over these accounts into a self-directed IRA when they leave an employer.

Note: Fee levels are dependent upon the type of account and account size. Minimum assets for a client relationship are usually $100K. If you cannot meet this requirement, an alternative minimum fee arrangement may be feasible. Please contact us with a description of the portfolio(s) you would like to have managed and we can tell you our fee level. Our fees are very competitive within the asset management industry. Percentage fee levels decrease as asset levels increase.

Our firm will not have direct access to any client funds, only trading authority, as granted by the client.

II.) Consulting on a fixed fee or hourly fee basis.

ECM will also provide advisory services on a consulting basis. Such services are for short-term projects such as analyzing an investment portfolio, recommending a model portfolio for a new investment program, or providing a second opinion on an investment program being managed by another investment adviser.

The fee for such a service would be charged based on an hourly rate that depends on the complexity of the work, how quickly it must be performed, and who is doing the work. The fixed fee would be determined by the adviser’s estimate of hours required, the hourly rate, the urgency required for the project, and any other factors, such as required travel. Fees are negotiable.

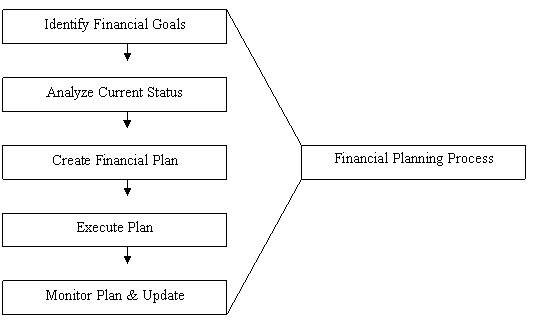

III.) Financial Planning

For interested clients, we can provide financial planning as described by the five step process below:

When designing a financial plan we incorporate the following components:

A. Emergency Fund Analysis

B. Retirement Planning

C. College Planning

D. Wealth Creation (non-retirement accounts)

E. Income Protection

F. Estate Planning

The actual components used will depend on the client’s financial goals.

Note: We will consult with other professionals, e.g., CPA, attorney, insurance specialist, as needed.

Fees for financial planning are assessed on a fixed or hourly basis, as for consulting.

More information on our Financial Planning services can be obtained by contacting Kirk Weiss (Phone: 412-215-0910, or e-mail: kweiss@emmanuelcapital.com).