Market Commentary—4th Quarter, 2011

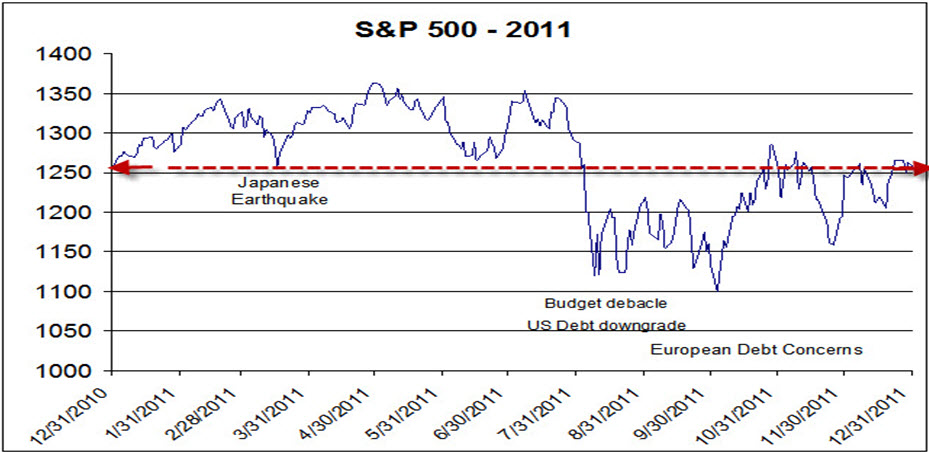

The US stock market, as represented by the S&P 500 Index, amazingly closed 2011 at almost the exact level that it began the year. As the graph below indicates, stocks spent most of the first half of 2011 in positive territory. In March, markets were initially jolted by the Japanese earthquake and tsunami, but then began to recover as the damaged reactors came under control. However, the dysfunctional political process in the U.S. regarding the budget and debt ceiling in July led to a downgrade of U.S. debt and an almost 20% decline in stock prices.

At the same time, the sovereign debt crisis in Europe caused fears of another “contagion”, in which defaults could potentially spread, from country to country, and involve several European banks. When the market bottomed on October 4, many investors believed that another global recession could be on the horizon.

As shown in the following table, the S&P 500 Index had a small total return of 2.1% in 2011, which was generated by dividends. However, most major stock indices showed negative total returns in 2011.

Total Returns; Major Indexes for Periods Ending December 31, 2011

| Annualized | ||||||

|

Index |

Sector |

Quarter |

1-Year |

3-Year |

5-Year |

10-Year |

|

S&P 500 |

Large US Co’s |

11.8% |

2.1% |

14.1% |

-0.3% |

2.9% |

|

MSCI EAFE |

Large Int’l Stocks |

2.9% |

-14.8% |

4.5% |

-7.4% |

2.0% |

|

BarCap AGG |

US Bond Mkt. |

1.1% |

7.8% |

6.8% |

6.5% |

5.8% |

In particular, international markets were down sharply due to the economic problems in Europe. Small company stocks and emerging market securities suffered even more as investors shifted from higher to lower risk assets. Concerns over a slowing Chinese economy added to selling pressure. However, U.S. markets enjoyed a strong recovery in the fourth quarter, as fears of a recession receded due to better-than-expected economic performance. GDP, employment, and housing data showed signs of improvement.

Ironically, even though the S&P 500 Index had little net change over 2011, it was one of the most volatile years on record. It was like a roller coaster with numerous drops, dips, and inversions that ended up at the same place it started – but left most of its riders nauseous. From its high point on April 29 to its lowest level on October 4, the S&P 500 declined 19.4%. The headlines in the summer and fall regarding U.S. and foreign debt problems caused markets to be extremely skittish. Since August 1, the S&P 500 Index closed more than 2% lower or higher than its previous day’s closing price on 32% of all trading days. It moved more than 3% from its previous day’s close on 11% of all trading days.

More so than in most years, economic circumstances were being dictated by politicians and bureaucrats rather than market forces, both in the U.S. and overseas. The actions and inactions by Congress, the Federal Reserve, the European Central Bank, and politicians across Europe created an extreme level of uncertainty for investors. Uncertainty usually equates to risk and greater market volatility.

While negative for stocks, this heightened sense of risk was positive for the U.S. government bond market. As investors looked to escape foreign bonds and the volatile stock market, they moved money into U.S. government bonds. This occurred despite a downgrading of the U.S. credit rating, the lack of a solution to U.S. fiscal problems, and the ever expanding federal deficit. Demand for government bonds pushed down the interest rate on the 10-year Treasury Bond to 1.88% at year end from 3.30% at the end of 2010. The BarCap Aggregate Bond Index, the broadest benchmark of the U.S. bond market, produced a total return of 7.8% in 2011.

There are a number of factors that should contribute to positive stock market performance in 2012. Stocks are cheap by historical standards, corporate earnings are at record levels and are expected to increase, corporate balance sheets are in great shape, and stocks’ dividend yields compare favorably with interest from bonds. However, these factors are primarily offset by serious fiscal problems facing the governments of most developed countries. In addition, many investors have lost interest in equities due to their underperformance during the past ten years.

It is likely that it will take a while for the global economy to regain its momentum, although 2012 has begun well, as of this writing. Corporations have adapted their business models to deal with the less robust environment and are prospering. In this regard, investors with patience, investment discipline, and a long-term perspective are likely to be rewarded as the economy gradually recovers and confidence returns to equity investing.

Please contact us if you have any questions about the markets or your accounts.

—Tom Franks & Kirk Weiss