Market Commentary–3rd Quarter, 2011

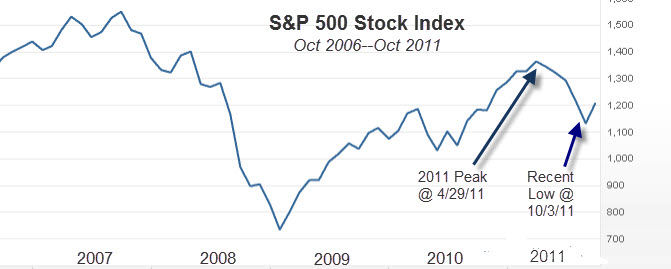

Concerns over slowing economic growth across the globe produced a significant correction for virtually all major stock markets in the third quarter. The S&P 500 Index lost 13.9% during the third quarter and has lost 17.1% from its 2011 high which occurred on April 29. It was the worst third quarter performance for the S&P 500 since 1928, according to Bespoke Investment Group. Foreign stocks, as represented by the MSCI EAFE International Index, had a bigger third quarter loss of 19.6%.

Total Return Performance of Major Indexes for Periods Ending on September 30, 2011

| Annualized | |||||||

|

Index |

Sector |

Quarter |

YTD |

1-Year |

3-Year |

5-Year |

10-Year |

|

S&P 500 |

Large US Co’s |

-13.9% |

-8.7% |

1.1% |

1.2% |

-1.2% |

2.8% |

|

MSCI EAFE |

Large Int’l Stocks |

-19.6% |

-17.2% |

-12.0% |

-4.0% |

-6.1% |

2.4% |

|

BarCap AGG |

US Bond Mkt. |

3.8% |

6.4% |

5.3% |

8.0% |

6.5% |

5.7% |

The chart of the S&P 500 below shows that the recovery that began in 2009 has had some setbacks, and the recent quarter was one of the most significant.

While the global economy was struggling going into the third quarter, the inability to favorably resolve budget and debt problems in both Europe and the U.S. has seemed to erode consumer, business, and investor confidence. The Greek debt crisis remains in the news on a daily basis, currently without a solution. The failure of the U.S. Congress to address short and long-term budget issues in July, compounded by a rating downgrade of US debt by Standard & Poors were the major contributors to the U.S. market’s steep decline. The problems in reaching an agreement for raising the debt ceiling highlighted the ineffectiveness of Congress in dealing with important economic issues. More so than in most time periods, the global economy is currently dependent on politicians and bureaucrats to act forcefully and intelligently. Policy decisions currently in the hands of government officials will have a significant impact on the global economy over the next year.

The steep market correction also reflects that many investors now believe that the U.S. has either entered another recession, or will shortly enter one. There is an old Wall Street adage which says that the market has predicted 9 of the last 5 recessions. In a number of instances, the market has declined in anticipation of a recession; however, many of those recessions never materialized. For example, in the summer of 2010 the market suffered a 15.9% decline on fears of a double-dip recession, which never occurred. The economy continued to expand and the market recovered strongly. The stock market also suffered major corrections in 1998 and 2002 due to fears of recessions which never happened. Investors are now more skittish after the major market decline in 2008-2009, and head for the exits if they sense a possible, significant downturn.

Unfortunately, the gains from the bottom of last year’s market correction have largely evaporated as recession fears are again unnerving investors. This pattern of short-term volatility combined with poor long-term returns has lead many investors to believe that market-timing is a viable strategy for generating returns – or at least avoiding losses. However, this strategy is fraught with danger, since predicting the events which cause market movements is virtually impossible.

A study by Dalbar for the 20 year period ending 2009 concluded that retail investors trail the market returns by 5% per year, mainly due to selling when prices start to drop, and buying when they rise, i.e., trying to time the market.

Even some institutional investors try market timing and come up short. Locally, The Pittsburgh Business Times August 2011 issue documented the City of Pittsburgh Pension board’s failed attempt to time the market. In August 2010, when the market was down and fears of a recession loomed, the board unanimously voted to sell all of its stock holdings on the advice of its investment consultants. At the time, the plan was invested 60% in stocks and 40% in bonds. After selling all of its equities last summer, the plan continued to hold no stocks until March 1, 2011. By then the market had recovered significantly and recessionary fears had faded. Between March 1 and March 31, 2011, the plan reestablished a 60% exposure to stocks. Of course, as is now apparent, the market timing strategy resulted in selling low and buying high. The Pittsburgh Business Times estimates that the strategy cost the pension plan up to $35 million, compared to having remained at a 60% stock/40% bond mix through the entire period.

Much of the selling that occurs during a market correction is based on emotion. After seeing a decline in market values, some investors become fearful that further losses will occur. This fear, and in some instances panic, will result in selling without any regard to the underlying value of the investments. For long-term investors who focus on the value of companies, there is no reason to sell undervalued positions, and if cash is available, a market correction usually presents an opportunity to buy. For example, renowned investor, Warren Buffett, commented to Bloomberg news that he had purchased $4 billion of equities during the third quarter as the lower market presented better values.

During market corrections, it takes a stronger resolve on the part of long-term investors to stick with an investment strategy. With the decline in market value, long-term performance is eroded and investors lose confidence in equities as a long-term investment vehicle. However, despite the negative news, there are a number of reasons for owning equities:

- Stocks appear to be undervalued compared to their long-term earnings potential, dividends, and other valuation metrics. For example, the S&P 500 is trading at just 11.0 times forward earnings, significantly below its historical average.

- Earnings for U.S. companies are at record levels. While the S&P 500 Index trades at approximately the same level it was 10 years ago, earnings for the index have increased from $38.85 in 2001 to an estimated $98.02 for 2011.

- Cash on corporate balance sheets is at record levels; balance sheets are in great shape. Treasury Strategies, a consulting firm, reported that corporate cash now stands at $2.05 trillion, 4.5% higher than the previous quarter, and 46% higher than in March 2009.

- Stocks now generate more income than bonds. The dividend yield of the S&P 500 is currently 2.39%. The yield of the Barclays Capital U.S. Aggregate Bond Index is 2.35%. The yield on the 10-year Treasury bond is 1.71%.

- Expectations for stocks and the economy have declined significantly in recent months. If a recession does not develop, stocks are likely to rally, as they did is the fourth quarter of 2010.

- Politicians are likely to take actions that will boost stock prices. We are currently in the third year of the presidential cycle. The third year is by far the best performing year of the four-year presidential cycle, probably due to actions intended to stimulate the economy and markets prior to the presidential election in the fourth year. There has not been a negative third year since 1939. Since 1930, the S&P 500 Index has average 18.4% in the third year of the presidential cycle.

Economic conditions are weak in Europe and the U.S. and another recession is possible. Consumer demand is soft because individuals are saving rather than borrowing and spending. Banks are no longer lending to unqualified borrowers. Unemployment is high in many areas due to layoffs in the bloated public sector. Long-term funding and spending issues regarding entitlement programs are finally being addressed. The road to a stronger economy and higher stock prices is likely to be unpredictable with many ups and downs.

However, there are many constructive factors in place which should eventually lead to a positive outcome for patient, long-term oriented investors. (As of this writing, the S&P is up about 6% since the start of October, which is a positive sign that a market recovery is possibly underway.)

Please contact us if you have any questions about the financial markets or your accounts. If current market volatility is uncomfortable for you, you may want to consider a more conservative investment objective. This will reduce your long-term expected return, but may be the most appropriate action given your risk tolerance and future goals. We have developed a new questionnaire to help you make this decision.

—Tom Franks & Kirk Weiss